Fsa Eligible Expenses 2025 Irs – For qualified adoption expenses, the credit is $16,810 in 2025 The 2025 tax year sets the monthly limit for qualified transportation and parking fringe benefits at $315. Health FSA . With a few strategic moves, you can significantly lower your tax bill or boost your refund. Let’s dive into some expert tips that can help you save big in 2025. Bulk Up Your 401(k) Contributions .

Fsa Eligible Expenses 2025 Irs

Source : www.fool.comFlexible Spending

Source : www.trinity-health.orgHSA Eligible Expenses in 2023 and 2025 that Qualify for

Source : www.fool.comIRS Releases 2025 HSA Limits DataPath Administrative Services

Source : datapathadmin.comBright Wood Corporation on LinkedIn: The enrollment deadline for

Source : www.linkedin.com2025 HSA, FSA, Retirement Plan Contribution Limits Announced

Source : hrwatchdog.calchamber.comFSA Archives Admin America

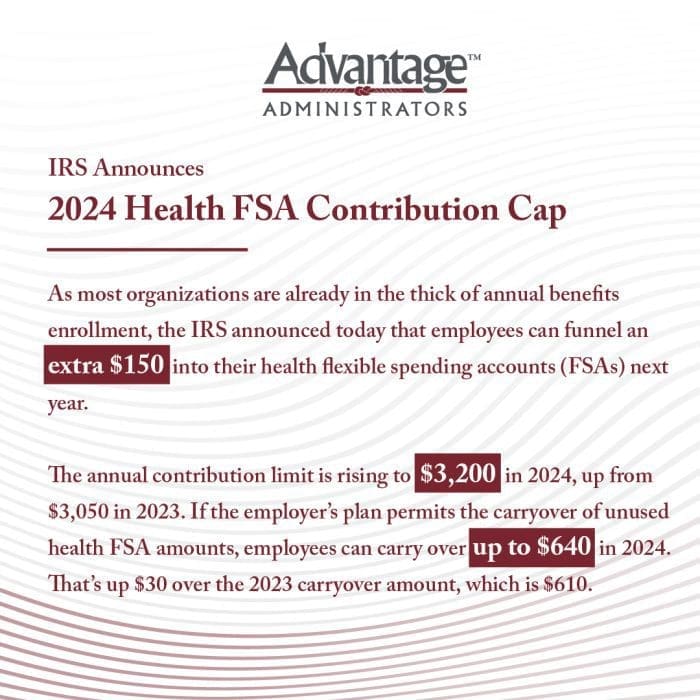

Source : adminamerica.comThe IRS Just Announced the 2025 Health FSA Contribution Cap!

Source : advantageadmin.comIRS Announces 2025 Increases to FSA Contribution Limits | SEHP

Source : sehp.healthbenefitsprogram.ks.govIRS Makes Historical Increase to 2025 HSA Contribution Limits

Source : www.firstdollar.comFsa Eligible Expenses 2025 Irs HSA Eligible Expenses in 2023 and 2025 that Qualify for : For the 37% of FSA users who have the optional grace period deadline along with a 2023 plan year deadline that ended on December 31, 2023, March 15, 2025 an eligible FSA expense? FSA eligibility . A health savings account (HSA) is a tax-advantaged savings account designed specifically for medical expenses. To be eligible to an employer. A flexible spending account (FSA) also allows .